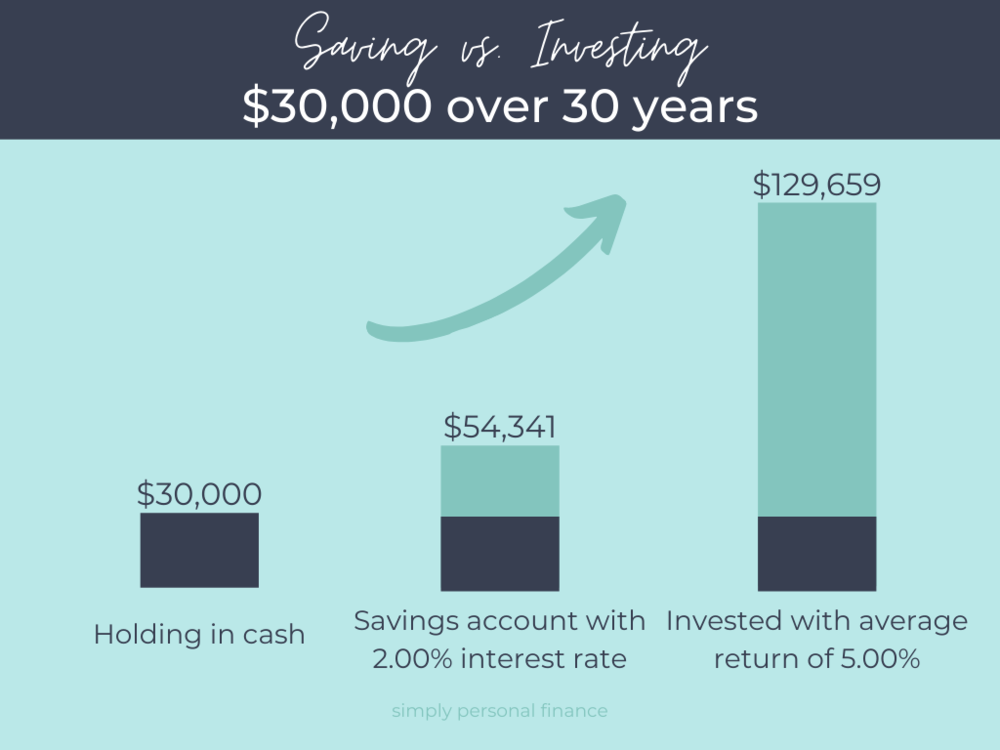

If you’re in your twenties like me, you’re probably in a mindset where you don’t think you need to worry about retirement until you’re much older. But actually, the earlier you start investing for the future, the less of your own money you will have to put away in the long run. This is all thanks to the compounding effect.

We are told that we are supposed to work for 30-40 years saving only 10-15% of our income then retire off of that money for another 30-40 years. I’m sorry… how? This is where investing comes into play and becomes a crucial part of building wealth long term.

Is The RRSP A Savings Account?

Just like your Tax Free Savings Account (TFSA), within your Registered Retirement Savings Plan (RRSP) you can hold money in high interest savings accounts or you can invest your money in stocks, guaranteed investment certificates (GIC’s), index funds (mutual funds and exchange traded funds) and more.

Learn more about TFSAs at What Is The Tax-Free Savings Account (TFSA)?

Learn more about investment products at The Basics Of Investing in Canada

Who Should Open An Account?

Most of us cannot just save enough for retirement, we also need to invest our money for retirement. A key element to investing is time. Canadians can start contributing to an RRSP account as soon as they start making taxable income. The minimum age you can start working in Canada is around 14-16.

Making meaningful contributions when you’re young is important, but you’ll want to take full advantage of your RRSP at what you believe to be your peak earning years. Why? Because the RRSP provides some clear tax benefits.

Tax Sheltering And Deferring

Your RRSP, like your TFSA, is a tax-sheltered account, meaning that you will not have to pay tax while your money is growing in the account. There are some exclusions to this like US stocks but I’m not going to get into that here.

Usually when you make money off of an investment by selling a stock and making a profit, you will need to pay taxes on whatever the increase in value is. So let’s say you buy a house at $300,000 and you sell it a few years later for $600,000. This investment is not tax-sheltered and you will need to pay tax on the $300,000 that increased in value. But, if you were to use that same $300,000 to buy stocks in your RRSP and sell them a few years later for $600,000, you will not have to pay tax on the extra $300,000 while the money is still in that account.

Makes sense? Sort of?

Contrary to the TFSA, you can get a tax deduction for the money you initially put into the account. So if you make $50,000 per year at your job and put $10,000 into your RRSP that year, $10,000 is removed from your taxable income and you’ll only be taxed on $40,000 of income during tax season. Woohoo!

You will, however, pay tax on the money you withdraw from your RRSP account at a later date. This is known as tax deference. You will only have to pay tax on the money when you physically withdraw it from your RRSP account.

Remember, for the TFSA, you pay the tax upfront then withdraw the money without paying taxes. So, you’ll want to take advantage of your TFSA when you’re making a lower salary and paying less in taxes. With the RRSP, you get a tax cut upfront for putting money into the account then pay the tax when you withdraw it. You’ll want to optimize your RRSP contributions when you’re making a larger salary and paying more in taxes so you can take advantage of the tax break. With that being said, both accounts are well suited for the majority of Canadians at any time and I personally make contributions to both.

Did you know you don’t have to deduct an RRSP contribution the same year that you make a contribution? So, because I make a low salary now, I can continue to contribute to my RRSP but I don’t need to claim the tax deduction until the future when the tax benefit will help me out a little bit more.

The concept for utilizing your RRSP is that you will put money into this account during your high earning years to get a tax cut. Then, in the future when you decide to take out the money, you are banking on the fact that you will not be earning as much.

Less Earnings = Less Taxes

The money in the RRSP grows in the account tax-free. It’s only upon withdrawing the money from the account once you’re in retirement that you pay the tax. This money is considered the same as income tax. It’s like you’re your own boss and are working for yourself getting paid by your past self.

If you withdraw $300,000 from your RRSP (if we keep going off of the example above) all at once, the entire $300,000 will be taxed as income. So, in the governments eyes, it looks like you had a job and made $300,000 that year. Now if you also have a regular job making $50,000, the government will tax you having had an income of $350,000 that year.

I believe these first few years of the workforce will be my lowest earning years so I am still trying to utilize my TFSA as much as possible while I am paying a low percentage of tax on my income. However, I do think it is important to start utilizing my RRSP account as early as possible because I want to let that money start to compound. I want to ensure I am starting to save for retirement as early as possible and have a dedicated fund for the future that I cannot touch without being taxed out the yin-yang. Remember, personal finance is personal!

Contribution Limits

Similar to the TFSA, there is only a specific amount of money you can contribute into your RRSP. It is not unlimited. For 2020, this amount is 18% of your annual income up to a maximum of $27,230 (whichever is lower). The amount you’re allowed to contribute will accumulate over time once you start working and filing your taxes so if you don’t put in the maximum amount each year, don’t worry, it will be there for you when you’re ready.

If you do not yet have a CRA account, visit the Government of Canada site and please set one up. You’ll be able to see how much contribution room you have left and keep track over time.

It’s extremely important that you do not over contribute. You will generally be taxed 1% every month on excess contributions that exceed your limit by more than $2,000. This tax will most likely offset your investment returns so you want to be really really careful here.

Unlike the TFSA, when you withdraw the money from your RRSP account, you do not get the contribution room back. To be clear, your contribution room only pertains to the money you yourself put into the account. So if you put in $10,000 and it grows to $10,000,000, you have still only technically contributed $10,000 and can continue to contribute up to the maximum amount! Woohoo!

You can keep contributing to your RRSP until the age of 71, then at this point you will need to convert your RRSP to a Registered Retirement Income Fund (RRIF). You can start the conversion process as soon as the age of 55.

Home Buyers Plan

You can also use your RRSP as part of the Home Buyers Plan (HBP). This plan now allows you to withdraw $35,000 of money towards a downpayment on your first home without paying the hefty tax you normally would to withdraw funds from your RRSP. You will generally have 15 years to pay back the money so essentially, you’re taking a loan from yourself and are paying yourself back interest-free.

Normally when you withdraw from your RRSP prematurely, you don’t get your contribution room back. But if you are withdrawing as part of the HBP, you’ll get to keep your contribution room. If you choose to take part in the HBP, make sure you fill out the proper paperwork prior to withdrawing the funds. You do not want to get taxed unintentionally for not following the proper procedure. Do your research!

You’ll have to weigh the pros and cons of letting the money continue to compound over time versus potentially lowering your mortgage amount right off the bat. It’s a personal choice! I am saving up for a downpayment in my TFSA account and leaving my RRSP for retirement as of right now. However, I can always roll the funds from my TFSA over to my RRSP if I change my mind later on.

Lifelong Learning Plan (LLP)

The Lifelong Learning Plan (LLP) allows you to withdraw $10,000 annually from your RRSP up to a maximum of $20,000 for education or training. The funds can be used for you, your spouse or your common law partner and you will not be charged withhold tax on the amount you withdraw. You’ll generally have 10 years to pay back the money to your RRSP. Think of it like taking a loan from yourself!

What Is Your Savings Goal?

Your savings goal for your RRSP should be investing for retirement, saving up for a home and/or education if you think the home buyers plan or lifelong learning plan is the right way to go for you.

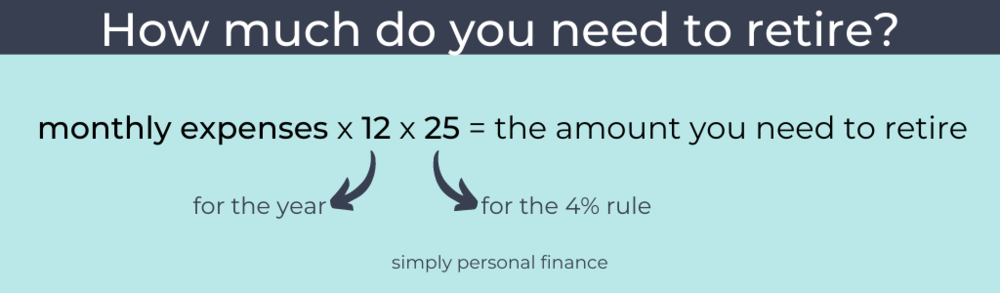

How much money should you have in an investment account for retirement?

If you want a general guideline and have an actual number to work towards, start here:

The 4% rule assumes you retire at the age of 65 and withdraw 4% from the investment account each year of retirement. Don’t know what your monthly expenses are? Learn more at How To Start Budgeting.

Again, this calculation is a very general guideline but it can be helpful to have at least some idea of what you need to work towards. You’ll also need to consider what you want your retired life to look like. If you want to shop exclusively at Whole Foods, travel constantly and eventually end up in a fancy old folks home, you might need to save up a little bit more to make sure you don’t run out of funds!

Withdrawal Penalties

If you withdraw funds from your RRSP before you reach the age of 71, you’ll have to pay what is called the RRSP withdrawal tax. This tax is 10% when you withdraw between $0-$5000, 20% between $5,001-$15,000 and 30% for withdrawing $15,001+. Yikes. Note these percentages are slightly different for residents of Quebec and non-residents of Canada.

Generally the RRSP is the account you use to hold your investments and once you need to start withdrawing funds for retirement, you would convert it to a Registered Retirement Income Fund (RRIF). Remember, when you withdraw money from your RRSP, you pay withholding tax and you do not get any contribution room back (unless you’re withdrawing as part of the Home Buyer’s Plan or Lifelong Learning Plan). There are pros and cons to both the RRSP and the RRIF so at this point you’ll most likely want to be working with a financial professional, like a fee-only based financial planner, to help you optimize your retirement withdrawals for your specific situation.

Who Shouldn’t Use An RRSP?

For most Canadians, contributing to an RRSP is extremely useful and can be an important part of building wealth over time. However, there are certain circumstances in which people shouldn’t contribute to an RRSP:

-

If you know you’re going to be receiving a hefty pension down the road, an RRSP might not make sense for your situation.

-

If you think your income will be higher in retirement when you are withdrawing the money, contributing to an RRSP does not make sense. You don’t want to defer the tax and end up paying more in the future.

-

If you are making a very small salary each and every year.

Again, for the majority of people, RRSP’s are a great investment vehicle for building wealth. However, in some cases, RRSPs simply don’t make financial sense. If you’re not sure if you should use an RRSP, consult a financial professional. Please don’t just walk into your bank for “free advice”, ensure that the financial planner or advisor you choose to work with works on a fee-only basis and is not associated with selling you financial products.

How To Set Up An Account

RRSP savings account or GIC

Now if your specific savings goal won’t allow you to take any risk and losing even a penny would be devastating for you, you should probably set up an RRSP savings account or GIC to keep your money super safe all while taking advantage of the tax sheltering. You’ll need to set one up directly with your financial institution of choice.

I wouldn’t just walk into your current bank and set one up, be sure to shop around and find the best rate. As long as the bank or credit union is CDIC insured, your money is safe. The best bank I’ve found for RRSP high interest savings accounts is Alterna Bank.

RRSP Investment account

Now if you are in your twenties like me, you should definitely be investing and not just saving for retirement. If you are in your thirties, forties, even fifties, you should most likely be investing for retirement as well. With a longer the time horizon, there is less risk and therefore a greater chance of success in building wealth!

As soon as you chose to invest, you need to be mentally okay with the possibility of both losing and gaining money over time. Investing can be a bit of a rollercoaster ride and your ability to cope with the ups and the downs is what is known as “risk tolerance”. You’ll usually need to take a questionnaire when signing up with a company who will manage your investments but you can also take this Vanguard Questionnaire if you’re interested to get an idea of where you’re at.

Index Funds

If you’re looking to invest in index funds, the TD e-series are highly recommended products in the Canadian personal finance world.

Exchange-Traded FUNDS (ETFS)

I personally have an RRSP set up with Wealthsimple (minimum initial investment is only $1!) and have always invested in exchange traded funds (ETFs). Wealthsimple along with Questwealth Portfolios, Nestwealth, Justwealth and many others are online investment management services (aka roboadvisors) in Canada that will deal with all of the investments for you for a fee of around 0.5%.

If you’re comfortable buying ETFs on your own, Questrade and Vanguard ETFs are also highly recommended. Once you start investing yourself, fees become closer to 0.2% or less!

Individual Stocks And More

If you’re interested in investing in individual stocks, options and more, popular brokerages include Questrade, TD Direct Investing and CIBC Investor’s Edge.

You can also find an investment firm or wealth management company and hire them to manage your investments. Remember, you always want to keep your fees below 1% and they likely won’t work with you until you have a few hundred thousand dollars ready to invest with them.

I’m not going to include options for mutual funds because you should already know by now, that is not a good way to invest in Canada!

If you’re not sure what I’m talking about or want to learn more about these different kinds of investment products, check out The Basics of Investing In Canada.

All In All

An RRSP account is an extremely useful investment account for the majority of Canadians, but not for all.

If you really do not know where to start when it comes to investing, open up a TFSA account first and then start using an RRSP once you feel more confident that it is right for you. You can always roll your TFSA funds into your RRSP but not the other way around!

“Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do. ”

Related Articles

The Basics of Investing In Canada

When Is The Best Time To Start Investing?

What Is The Tax-Free Savings Account (TFSA)?

Disclaimer: I am not a certified financial planner or investment advisor. The ideas posted on this website are my own opinions on how I manage my personal finances. The content is specifically for educational and informational purposes and is not considered professional financial advice. Everyone’s finances work differently and you will have to do your own due diligence before making any financial decisions.

Pin it for later!

Alix,

A well written explanation. The equation to figure out how much you need to retire is very useful.

Write on!

N. R. Zacharczuk