Welcome back to school! While this year might look a little different for a lot of us, one thing is still for sure and that’s paying for tuition. My entire first year of pharmacy school will most likely be online but that sure won’t be changing the hefty price tag.

My parents helped me graduate debt free from my undergraduate degree but for my professional doctorate degree, I’m on my own. Here are my tips for managing that student loan like a boss!

Sign Up For A HISA

If you don’t already have one, you need to sign up for a high interest savings account. This is non-negotiable. Do it. Right now!

The bank I’m currently using and have been for the past two years is EQ Bank and their current interest rate is 1.7% (will soon drop to 1.5%) I also have a HISA with LBC (their current interest rate is also 1.5%) but EQ Bank is hands down more user friendly.

What’s a high interest savings account?

A high interest savings account simply pays you more money than a regular savings account at your regular bank. Did you catch that? They pay you more! Some savings accounts in Canada and the US offer as little as 0.01-0.05% interest. The 1.7% I’m getting with my high interest savings account at EQ Bank is literally 34-170x that amount.

Just for context, I was looking over a friend’s finances over the weekend and we found out their savings account was offering them a 0.05% interest rate. We both have around $9,000 in our savings account and during the month of September, they made $0.25 while I made close to $13. That’s a huge difference!

While it may not seem like a lot of money, it’s can add up to be a significant difference over time. Over the past few years I would have lost out on hundreds of dollars if I had stayed with my traditional savings account.

Layout Your Student Loan Information

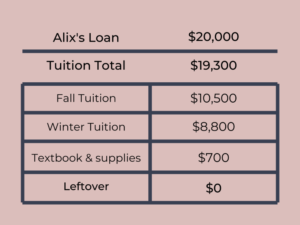

Example 1: Meet Alix!

Alix is attending a professional degree program at UBC in Vancouver (hey look it’s me!). Let’s take a look at her schooling costs!

Alix’s first instalment was $14,200 and it was received in early September 2020. She will receive another payment of $5,800 in January 2021.

In September, Alix will transfer the entire $14,200 into her high interest savings account and pay her $10,500 tuition when it is due in early October. She can spend $700 on textbooks but cannot exceed that amount. When the second loan payment of $5,800 is received in January, she will use that along with the $3,000 left in the account to pay for her winter tuition.

With the interest payments received along the way, Alix can either transfer that income to other savings accounts or use it as spending money. She will definitely need a part-time job or an additional loan (ie student line of credit) to pay for her living costs.

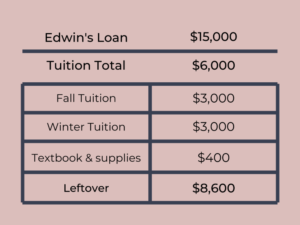

Example 2: Edwin

Edwin is attending their undergraduate degree at Queen’s in Kingston. Let’s take a look at their schooling costs!

Edwin’s first student loan payment was $10,000 in September and they will receive a second payment of $5,000 in January 2020. Overall, Edwin will be able to pay his tuition in full and live on $1,075 for the 8 months of school year ($8,600 leftover / 8 = $1,075).

First, Edwin will transfer $8,925 into their high interest savings account, leaving $1,075 in their chequing account to spend for the month of September. When the tuition is due in early October, Edwin will transfer $3,000 from his account to pay for it.

Moving forward throughout the year, Edwin will transfer $1,075 from the high interest savings account into the chequing account at the beginning of each month for spending money. This means that Edwin will be able to pay the rent costing $600 each month and still has $475 leftover for groceries and other activities.

Related Articles

How Your Money Mindset Is Killing Your Financial Confidence

10 Things To Start Doing To Build Wealth

How To Create An Effective Spending Plan

Start Budgeting

Sorry not sorry! You’ve got to start budgeting. How else are you going to know how much money you have left to spend?

I wish I knew how to budget in undergrad. I remember calling my mom when I looked at my online banking and had less than $3 in my account. $3!! How the heck did I not know how much money I was spending and how much I had left to spend? Don’t be me.

Step 1: Transfer your entire student loan into your high interest savings account

Step 2: Pay your tuition by the due date

Step 3: Pay yourself every two weeks or every month like a regular job would

Step 4: Pay for your necessities (rent, groceries, subscriptions etc.)

Step 5: Calculate how much is leftover to spend

Step 6: Keep track of all your monthly transactions in a budget spreadsheet or check out

Mint

Learn more at How To Start Budgeting

Consider An Additional Line Of Credit

If you’re in a professional program like me, the amount from your provincial or federal loan might not be enough to cover the entire cost of your program tuition and your living costs. If this is the case, you might want to look into a student line of credit. Do your research! Rates for lines of credit are usually about 3-5%, the lower the better.

For both your government student loan and your line of credit, you’ll normally get a grace period of six months or longer after you graduate before you have to start making payments. However, the annoying thing about a line of credit versus a student loan from the government is that the interest starts racking up right away. As soon as you take money out of the line of credit, you are being charged interest. Government student loans don’t start charging interest until after you graduate.

With that being said, you won’t be charged interest on money you don’t use in a line of credit. So if you never end up taking out any money, you won’t be charged. Just remember, whatever money you do end up using you will need to pay back. Be mindful of how you are spending this money and only use what you need. It is definitely not free money.

I’ll be sure to make another post about my experience with a student line of credit when the time comes. Stay tuned.

Stay On Top Of It

Loans, money and personal finance in general is an extremely stressful topic for literally everyone. You are not alone! BUT, turning a blind eye and saying “that’s a future me problem!” is not the best route to take here. Stay on top of what you owe and stay on top of what you’re spending.

Should you really be buying that Gucci sweater with the governments money? Do you really want to pay interest on that in a few years time? Mmm, probably not.

Should you be spending that money on tuition, groceries or rent or dare I say saving some of the money to pay back your loan if you don’t actually need to use it? Hell yes! Whenever you borrow money, you need to be prepared to pay it back plus a little extra. You don’t want to have any regrets about where that money went, trust me on that.

Being in control of your finances (even when the money is not yours!) is the best thing you can do for yourself now and in the future. Don’t let fear or confusion scare you away from managing your money right the first time. You’ve got this!

Pin it for later!

Alix, your examples are crystal clear for anyone with a student loan. Wonderful writing!